---------- Forwarded message ----------

From: Rude Awakening <rude@agorafinancial.com>

Date: Wed, Aug 13, 2014 at 6:46 AM

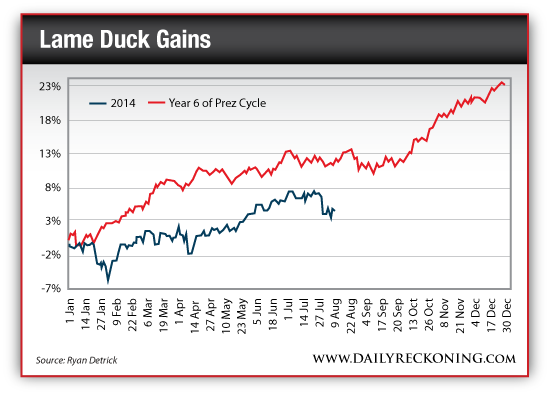

Subject: How a Lame Duck President Can Juice the Market

To: iammejtm@gmail.com

From: Rude Awakening <rude@agorafinancial.com>

Date: Wed, Aug 13, 2014 at 6:46 AM

Subject: How a Lame Duck President Can Juice the Market

To: iammejtm@gmail.com

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Jeremy Tobias Matthews

© 2014 Agora Financial, LLC. 808 Saint Paul Street, Baltimore MD 21202. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice.

© 2014 Agora Financial, LLC. 808 Saint Paul Street, Baltimore MD 21202. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice.

No comments:

Post a Comment